Newsletter

Issue 44, October 2024 | www.scientificbeta.com

Bridging the Gap between Academia and Industry

| Editorial | Features | Interview | Publications | News | Events | Press Review | About |

How to Squeeze the Most out of Your Tracking Error Budget

Investors can pursue sustainability objectives and performance goals using evidence-based strategies, all while keeping their portfolio aligned with cap-weighted indices and maintaining full transparency to make informed investment decisions.

Evolving investor objectives: From cap-weighted indices to enhanced solutions

Cap-weighted indices have long dominated the asset management industry, because they represent a yardstick for performance evaluation, are fully macro-consistent and allow implementing investments with great ease, even for the largest investors. Unsurprisingly, even the most sophisticated equity investors, such as large pension funds and sovereign funds, typically need to align their portfolios largely with cap-weighted indices. At the same time, these investors do not aim to simply follow the market but want to address several important investment objectives. Improving portfolio sustainability by emphasising companies with responsible behaviour or positive impact on society ranks high on the list. Likewise, many investors seek a certain performance uplift over cap-weighted indices, even when retaining close resemblance to these indices.

Investment managers are trying to address these concerns with "low tracking error" or "core" offerings, as well as an increasing number of customisation tools that allow tilting to sustainability or factor objectives. However, investors are faced with several challenges when trying to implement their objectives in this setting.

Sustainability ambitions should be addressed with objective metrics, not subjective opinions

Building sustainability into equity portfolios hinges on the available metrics of sustainability. Current ratings on climate issues, ESG issues, or sustainable development goals (SDGs) are frequently described as mere "opinions," which explains the inconsistency and divergence among providers. Investors need a more reliable method that prioritises objectively measured outcomes over subjective assessments to ensure genuine progress in sustainability1.

One effective solution is Scientific Beta's Climate Transition Risk (CTR) beta, which provides a more systematic approach to measuring sustainability. CTR beta enables investors to leverage market-based information that reflects forward-looking information on climate risks. Moreover, investors in climate strategies need to look beyond risk avoidance and consider how to seize opportunities related to the green economy. Recent trends in regulation provide fresh data that allows integrating the dimension of green revenues without relying on substantial subjectivity. This approach to sustainability allows investors to rely on objective, transparent, and verifiable information to make sound investment decisions.

Weighing sustainability and performance objectives

Tailoring portfolios in terms of sustainability objectives may lead to unintended consequences on investment outcomes. For example, when targeting ESG goals, investors need to consider how different sustainability objectives may conflict with each other. Moreover, sustainability objectives per se do not ensure that the portfolio targets effective return drivers. Therefore, investors may benefit from including financial return drivers in their sustainable investment portfolios, such as targeting stocks of quality firms that invest conservatively and achieve robust profitability, to achieve higher returns in the long-term. Importantly, such return drivers are not just backed by thorough academic evidence, but are also grounded in sound investment principles. In fact, starting with corporations that maximise net present value of their investments, financial models show that firms with conservative investment and robust profitability also should have higher expected stock returns going forward. Thoroughly analysing such return drivers together with sustainability objectives, allows investors to identify suitable strategy design for their objectives.

Using reliable and transparent risk management to target investors' risk budgets

Sustainability and exposure to return drivers will mechanically lead to deviation from the cap-weighted benchmark of an investor. Effectively controlling the deviation between a portfolio's returns and its cap-weighted index has been a challenge. Traditional stock-level optimisation methods are hard to interpret, suffer from picking up estimation errors, and often lead to exceedance of budgets after portfolio formation. In contrast, Scientific Beta proposes a transparent, portfolio-level approach that forecasts tracking error dynamics over time and adjusts the strategy accordingly in a transparent fashion. This method significantly reduces the tracking error exceedance compared to traditional optimisation techniques, enabling investors to achieve their objectives with greater confidence. Established products in the "core" or "enhanced indexing" strategy display surprisingly large variations in tracking error, which may double during periods of market stress. Scientific Beta's methods to strengthen risk control provides investors with greater confidence that risk budgets will be respected across market conditions.

Make smart use of your risk budget with Scientific Beta's Market+ solutions

With limited room for manoeuvre and numerous objectives, investors need a new approach to portfolio construction. In this context, Scientific Beta is introducing a fresh set of strategies that enable investors to align their portfolios closely with the market (the cap-weighted index) while achieving sustainability and return targets. Unlike other solutions available on the market, Scientific Beta's robust method for tracking error control avoids excessive variability of tracking error levels over time and ensures a more stable outcome, allowing investors to target their tracking error budget more precisely.

The new Market+ approach is based on over a decade of research in risk management and tracking error control. It enables benchmark-constrained investors to fully use their available margin for pursuing return and sustainability objectives. Market+ thus allows investors to leverage our full range of evidence-based insights on sustainability and return-drivers even when they have a tight risk budget.

This subject will be discussed in detail at the Scientific Beta Days Europe conference on 26-27 November, 2024 in London: Complimentary registration.

Replacing the Black Box: Achieving Reliable and Transparent Tracking Error Control

Equity investors often need to maintain alignment with cap-weighted indices, which are used as an important performance yardstick1. When pursuing additional return-drivers (such as quality or momentum tilts) or sustainability objectives (such as exposure to climate risk or harmful activities), such investors still aim to adhere closely to the cap-weighted benchmark. Tracking error, the measure of deviation between a portfolio's returns and its benchmark, has historically been challenging to control effectively. Scientific Beta provides an innovative solution that improves management of this risk, leading to more consistent investment outcomes.

Drawbacks of a black box approach

Ask any quantitative analyst about including tracking error constraints in a portfolio and you will get a straightforward answer. Just add a constraint in an optimiser. The problem with this answer is well-known: stock-level optimisation maximises exposure to estimation errors, which can be considerable. In addition, weighting decisions made by the optimiser are difficult to comprehend for investors, as they involve complex trade-offs between noisy estimates of thousands of correlation coefficients and stock-level tracking error parameters. What makes matters worse, is that optimisation often involves plentiful additional parameters on liquidity, turnover, sector and country exposures which need to be chosen in an ad hoc manner and – even when they work well in a backtest – might not achieve the desired result once investment begins.

As a result of these challenges with stock-level optimisation, realised tracking error may be substantially higher than specified in the constraint, a problem widely recognised by investors2.

A better way

To replace the black box of tracking error optimisation, we propose to control tracking error in a transparent way. We start with the unconstrained strategy of an investor that satisfied their objectives in terms of sustainability and financial return drivers. We draw on dynamic risk management methods to forecast how tracking error of this strategy evolves over time. Depending on this forward-looking assessment of tracking error, we then move the strategy closer to the cap-weighted benchmark. How much we modify the original strategy depends on how much is needed, given the dynamic risk forecast. Since we do not optimise across individual stocks, we avoid a large part of the estimation error inherent in risk forecasts. Unlike the result of Black Box optimisations, investors can easily track resulting weights, which are just a blend of the original strategy and market capitalisation weights.

Comparing different approaches to tracking error management

The table3 below shows how tracking error behaves for different approaches. The starting point is an unconstrained strategy. For illustration, we consider an unconstrained strategy that targets exposure to a range of style factors. We then consider several strategies that target a 1% tracking error. We consider optimisation strategies with and without additional constraints that aim at reigning in the impact of estimation error. Finally, we show results for the portfolio level approach.

SciBeta US Equity Universe (Data since December 2005) |

Unconstrained Strategy |

1% Tracking Error Target |

||

Naive Stock-Level Optimisation |

Constrained Stock-Level Optimisation |

Scientific Beta Portfolio-Level Approach |

||

| Mean Tracking Error | 3.68% | 1.52% | 1.32% | 1.13% |

| Tracking Error Variability | 1.51% | 0.44% | 0.39% | 0.28% |

| Worst Case (5%) Tracking Error | 6.83% | 2.72% | 2.32% | 1.70% |

The results show that optimisation leads to large exceedance of the 1% tracking error budget on average and extreme conditions even see almost a tripling of the tracking error compared to the acceptable level. In contrast, the portfolio level approach is able to reign in these exceedances to more moderate levels, due to its capacity to adapt via its forward looking approach to tracking error management.

Achieving tracking error objectives through forward-looking risk management

Given the well-known problems with black box optimisation for tracking error targets, our reliable and transparent method offers significant value. By employing forward-looking risk management, it effectively controls deviations from the cap-weighted benchmark, providing investors with greater confidence in achieving their objectives.

This subject will be discussed in detail at the Scientific Beta Days Europe conference on 26-27 November, 2024 in London: Complimentary registration.

A New Approach to Quality Investing: Combining Risk Awareness and Robust Metrics

Quality investing offers the potential for long-term outperformance of the broad equity market. However, quality strategies are implemented via a wide range of approaches. These implementation choices may lead to three important pitfalls, which the Scientific Beta Quality index has been designed to avoid.

Quality investing is popular among equity investors. This is illustrated by the large amount of assets that have been invested in for example quality-themed ETFs1 and the wide range of quality funds offered by large asset managers.

Quality investors aim to outperform the market by investing in high-quality firms. This objective is supported by a large body of academic evidence indicating that high-quality firms earn higher long-term average returns than low-quality firms. Research going back to at least the early 2000's has documented a positive relationship between, for example, profitability and stock returns. Importantly, later work confirms that quality explains differences between expected returns across stocks, providing out-of-sample evidence on the robustness of the earlier findings.

In practice, quality strategies are implemented via a wide range of approaches that may lead to different investment outcomes. These implementation choices may lead to three important pitfalls that are commonly found in quality investment products.

A first key question for quality investors is how to define a high-quality firm. In investment practice, investors face a broad array of quality definitions in equity indices2. Commonly used variables include leverage or earnings stability. The tendency of product providers to come up with new and improved ways to measure quality introduces substantial data snooping risk for investors. While it may be possible to create an attractive backtest based on such characteristics, they do not benefit from the same scrutiny of their robustness as other quality metrics, such as profitability and investment. On the contrary, recent research finds that many of the stock characteristics included in quality definitions in practice do not deliver a consistent return premium.3

Second, high-quality firms may include quality traps. These are firms that introduce a long-term performance drag due to unfavourable features, despite being a quality firm. Apart from quality, academic research has also identified other drivers of long-term expected returns, such as value or momentum. Value firms have a higher long-term expected return than growth firms, while a strategy of high momentum stocks outperforms a strategy of low momentum stocks in the long run. Quality stocks with high valuation or poor momentum therefore introduce a drag on the long-term performance of an investment strategy.

Third, quality strategies often have a defensive tilt, with an average market beta below one. Such strategies will therefore underperform the market during bull markets and miss out on part of the long-term equity risk premium. While a defensive bias is not necessarily a problem, it should be a conscious choice made by investors as opposed to an unexpected side-effect of introducing a quality tilt. Furthermore, the market beta can be highly unstable over time. Variability in market beta means that investors take on implicit bets on market performance over short horizons. Especially for investors with a relative return objective, this adds significant short-term risk to the strategy.

The Scientific Beta Quality index offers a new approach to implement a quality strategy. It is designed to avoid these pitfalls. A key feature of our index is its robust quality definition based on the profitability and investment characteristics. These characteristics have been scrutinised in practice and in the academic literature for over a decade. After the first evidence on their relationship with long-term returns, out-of-sample evidence has shown that this effect persists. Furthermore, a clear economic rationale explains why high profitability and low investment identify firms with high returns. If investors require a high expected return on a stock, this means that the firm faces a high cost of capital. Consequently, these firms need to be more disciplined in their investment decisions and can only select highly profitable projects as positive net present value investments.

Our index design also addresses other issues, that often lead to a long-term performance drag in quality strategies. We explicitly remove quality traps from our stock selection and introduce a weighting scheme that targets a stable market beta of close to one. The Scientific Beta Quality index is therefore a true quality strategy, whose relative performance is not driven by market regimes.

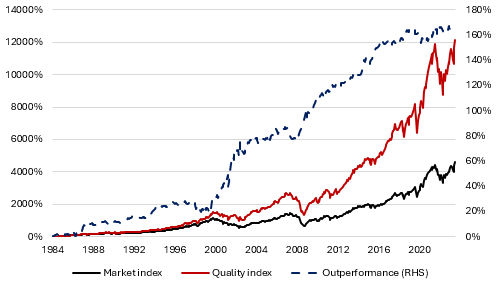

The graph below highlights how our index design features work together to deliver strong long-term returns, with a smooth cumulative outperformance over the cap-weighted market index over the past forty years.

Historical Quality Index Performance vs Market Index

Notes: Cumulative returns are based on monthly USD total returns from 30 June 1984 to 31 December 2023. The universe is the EDHEC Risk Long-Term Track Record Developed universe. The outperformance corresponds to the excess returns of the Quality index relative to the Cap-Weighted market index.

This subject will be discussed in detail at the Scientific Beta Days Europe conference on 26-27 November, 2024 in London: Complimentary registration.

The Two Sides of the Climate Coin

A current trend among climate investors is to put more emphasis on investing in climate solutions and "improvable" companies rather than merely divesting from fossil fuels and corporate laggards. For example, on 19 September 2024, the Institutional Investors Group on Climate Change1 published a position paper on transition finance that "promotes capital allocation and management of assets in line with the transition to a low-carbon economy". In practice, as the IIGCC puts it, "Huge volumes of capital are required to support both the decarbonisation of emission intensive industries and the scale up of climate solutions." This trend is welcome as it seeks to overcome what is perhaps the main flaw of the first generation of climate investment strategies, their one-sidedness.

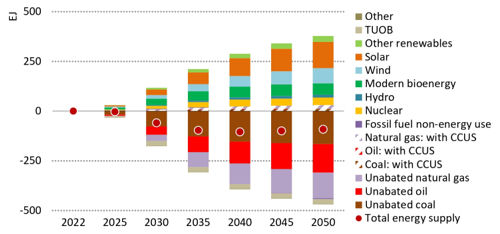

The graph below, taken from the International Energy Agency's Net Zero Roadmap, clearly illustrates that the pathway towards a low carbon economy has two sides to it: fewer and fewer fossil fuels on the bottom side, compensated by more renewable and low-carbon energy on the upper side. A one-sided approach would lead the economy towards a blackout.

Figure 1: Changes in Total Energy Supply by Source in the NZE Scenario, 2022–2050

Source: IEA, Net Zero Roadmap, 2023 Update.

It is therefore disappointing to see regulatory initiatives that go in the opposite direction. On 14 May 2024, the European Securities and Markets Authority published its Guidelines on funds' names using ESG or sustainability-related terms2. These guidelines will apply to new funds next month, on 21 November, and to pre-existing funds in May next year.

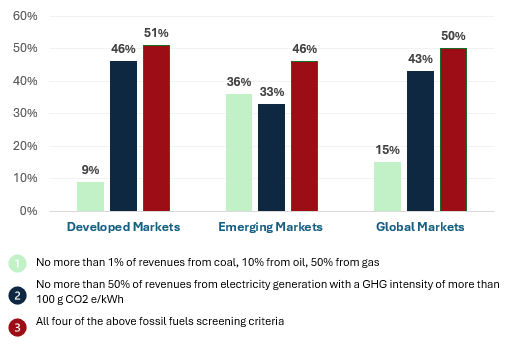

The ESMA guidelines will force European funds using "environmental", "impact" or "sustainability" related terms to exclude fossil fuels-related companies, with the same divestment criteria as defined for EU-regulated Paris Aligned Benchmarks. These criteria relate both to producers of fossil fuels and to electric utilities using them for power generation. The problem with this mandated divestment is that it focuses only on the "defossilisation" side of the transition coin. On the climate solutions side it is counterproductive, as the same fossil fuels companies represent about half of the total renewable electricity production in global listed equity universes, as shown in Figure 2.

Figure 2: Percentage of Renewable Electricity Revenues Generated by Different Categories of Fossil Fuel-Related Companies in Large Cap Equity Universes

Fortunately, there is a loophole in ESMA's guidelines: to avoid counterproductive fossil fuels exclusion requirements, investors can choose "transition" related terms to name funds. But that still leaves the question open on how to design two-sided transition finance strategies. At Scientific Beta, we have developed a holistic framework that combines a doubling of the funding for companies that offer climate solutions, with a pathway ensuring that the financed companies overall become gradually more carbon efficient. This framework can be used to create broad transition finance portfolios with low tracking error. It can also be applied to strategies that have a financial outperformance goal, as it is designed to minimise its interference with the factor exposure characteristics of the underlying strategy.

Another notable trait of Scientific Beta's transition finance framework is that it relies only on transparent and reliable climate metrics. In particular, we have developed a forward-looking climate transition risk metric that relies neither on corporate promises nor on proprietary crystal balls.

This subject will be discussed in detail at the Scientific Beta Days Europe conference on 26-27 November, 2024 in London: Complimentary registration.

Video: Insights and Innovations – A Preview of the Upcoming Scientific Beta Days Conference in November in London with Felix Goltz, Research Director

A short interview with Felix Goltz, PhD, Research Director at Scientific Beta, revealing some of the latest research on systematic equity investing that will be showcased at the Scientific Beta Days Europe conference on 26-27 November, 2024 in London.

What is the purpose of the conference?

The purpose of our conference is really to explore new ideas on how we are going to build equity portfolios better in the future. So, there will be research presentations from Scientific Beta researchers. There will also be external scholars from the academic community, and we will also have a roundtable with industry leaders to discuss new ideas. And we really hope that this will not only provide information for attendees, but also we hope that we will get feedback on our work and leverage discussion with participants.

Which topics are most relevant for investors?

So we will show some new results for benchmark-oriented investors. It is well known that traditional tracking error optimisation quite often is unreliable and so we will show new approaches of managing benchmark constraints in a robust and a forward-looking way. We will also show results on ESG metrics and we will show new ways of how investors can go beyond the very subjective ratings and actually use verifiable information and also forward-looking information to have ESG metrics that are much more fact-based and much more forward-looking.

Find out more about the Scientific Beta Days Europe conference on 26-27 November, 2024 in London and secure your complimentary registration.

Felix Goltz, PhD, is Research Director at Scientific Beta. He has been with Scientific Beta since inception. He carries out research in empirical finance and asset allocation, with a focus on alternative investments and indexing strategies. His work has appeared in various international academic and practitioner journals and handbooks, including the Journal of Portfolio Management, the Financial Analysts Journal, the Journal of Index Investing, the Journal of Investment Management and the Handbook of Finance (Wiley). He obtained an MSc and a PhD in finance from the University of Nice Sophia-Antipolis after studying economics and business administration at the University of Bayreuth and EDHEC Business School.

White Papers

In a concern for transparency, and as part of its aim to help investors to understand and to invest in smart factor and ESG/Climate indices, Scientific Beta has published a large number of white papers that are available on the Scientific Beta platform.

Featured White Papers

Improving Factor Exposure per Unit of Tracking Error: Managing Economic Risks to Improve Efficiency in Multi-Factor Equity Strategies

October 2024

This paper shows how equity investors can achieve higher factor intensity per unit of tracking error, improving the efficiency of their multi-factor strategies. This is a key metric for investors, which we refer to as 'factor efficiency'. By employing innovative measures of economic risk, the approach not only targets rewarded factors but also manages exposures to unrewarded risks, improving overall risk management.

This paper shows how equity investors can achieve higher factor intensity per unit of tracking error, improving the efficiency of their multi-factor strategies. This is a key metric for investors, which we refer to as 'factor efficiency'. By employing innovative measures of economic risk, the approach not only targets rewarded factors but also manages exposures to unrewarded risks, improving overall risk management.

The new approach makes sure that the tracking error of the diversified multi-factor strategies is used efficiently. Indeed, unnecessary tracking error, which is the consequence of implicit exposure to economic risks, is eliminated while strong exposure to rewarded factors and well-diversified portfolios is maintained. Consequently, the multi-factor strategies are more efficient since they capture a similar level of factor intensity and diversification but with a lower tracking error. Similar to cholesterol, tracking error can be classified as either 'good' or 'bad'. While 'good' cholesterol is necessary for the body to function properly, 'bad' cholesterol should be reduced since it can be detrimental. This is also the case with tracking error. Indeed, the majority of tracking error can be considered 'good' as it arises from desired deviations in relation to the cap-weighted benchmark. This allows for strong exposure to rewarded factors and diversification of idiosyncratic risks. Nevertheless, some of the tracking error is undesirable, or 'bad', in that it represents implicit exposures to economic risks that investors would prefer to avoid, and which can have a detrimental impact on short-term performance. Consequently, the utilisation of innovative and novel methodologies for the assessment and management of economic risks allows for the simultaneous management of both rewarded factors and exposures to unrewarded risks, thereby improving the efficacy of risk management practices.

A New Approach to Quality Investing: Combining Risk Awareness and Robust Metrics

September 2024

Quality investing offers the potential for long-term outperformance of the broad equity market. A large body of academic literature provides evidence that high-quality firms earn higher long-term average returns than low-quality firms. Consequently, many investors pursue quality investment strategies. The Scientific Beta Quality index offers a new approach to implement such a strategy.

Quality investing offers the potential for long-term outperformance of the broad equity market. A large body of academic literature provides evidence that high-quality firms earn higher long-term average returns than low-quality firms. Consequently, many investors pursue quality investment strategies. The Scientific Beta Quality index offers a new approach to implement such a strategy.

A first key question for quality investors is how to define a high-quality firm. We include firms with a high profitability and low investment in our quality stock selection. This parsimonious definition follows extensive evidence that these characteristics allow to distinguish between firms with high and low average long-term returns. Several other commonly used metrics, such as leverage and earnings stability, have been shown to lack robustness.

High-quality firms may include quality traps. These are firms that introduce a long-term performance drag because of their high valuation, high volatility, or low momentum. Our quality index explicitly removes quality traps from the stock selection. Therefore, the outperformance potential introduced by the quality tilt is not offset by a performance drag introduced by firms with these undesirable characteristics.

Quality strategies often have a defensive tilt, with an average market beta below one. Such strategies will therefore underperform the market during bull markets and miss out on part of the long-term equity risk premium. Furthermore, the market beta can be highly unstable over time. Variability in market beta means that investors take on implicit bets on market performance over short horizons. The weighting scheme of our quality index includes a mechanism that targets a stable market beta of one. As a result, the index delivers a smooth outperformance across market regimes and captures the full equity risk premium. Stable exposure to the market further ensures that investors do not take undue bets on short-term performance.

Joseph Simonian Delivering Keynote Presentation on Economic Risks in Factor Portfolios at the Markets Group 10th Annual Pennsylvania Institutional Forum

Joseph Simonian, PhD, Senior Investment Strategist at Scientific Beta, will be participating in the 10th Annual Pennsylvania Institutional Forum in Philadelphia on 6 November, 2024. At the event, Joseph will be delivering the Keynote Presentation on Managing Economic Risks in Factor Portfolios. This presentation will focus on a robust portfolio construction approach that can help mitigate economic risks of diversified multi-factor strategies, while preserving their benefits, namely attractive expected returns, via exposure to rewarded factors, and diversification of idiosyncratic risks. The methodology that Scientific Beta will describe enables the reduction of unnecessary tracking error to improve the efficiency of diversified multi-factor portfolios, by capturing stronger exposure to rewarded factors for the same level of deviation relative to the cap-weighted benchmark. This presentation is intended to provide asset owners with an alternative approach to standard equity factor strategies.

Scientific Beta is pleased to be Title Sponsor of the event, which is the region's leading conference for pension funds, insurance companies, foundations and endowments, hospital plans, sovereign wealth funds and consultants from throughout the region. The forum's content is developed through hundreds of one-on-one meetings with the institutional investment community.

Scientific Beta Engages with Investors at the Annual PLSA Conference in Liverpool

Scientific Beta was excited to have been present at the Pensions and Lifetime Savings Association's (PLSA) Annual Conference 2024 held in Liverpool on 15 to 17 October, 2024. Vera Cady, Senior Investment Specialist, and Ilan Heimann, Head of Business Development UK & Nordics, connected with investors at the Scientific Beta stand to discuss our latest research in systematic equity investing, risk management, and sustainable investment strategies, share insights and explore how to drive better outcomes for portfolios.

The conference is one of the UK's premier events for the pensions community, bringing together key stakeholders, including pension fund managers, trustees and policymakers, representing a key forum for thought leadership and providing insights into how pension schemes can adapt to an ever evolving financial landscape.

Conferences

Scientific Beta Days Europe 2024

26-27 November, 2024 – Covene Fenchurch Street, London, United Kingdom

The annual two-day conference, organised by Scientific Beta, is changing venues and taking place in London this year. It will present the asset owner and financial advisory communities with the latest conceptual advances and research results in factor and climate investing, enabling their implications and applications to be discussed with our eminent researchers, combining expertise of advanced financial techniques with a sound awareness of their industry relevance, and senior investment professionals providing industry insight into each topic. The event will include multiple plenary and practical sessions, allowing professionals to review major industry challenges, explore state-of-the-art investment techniques and benchmark practices to advances in research.

This year's in-person conference will focus on value creation through machine learning, sustainability integration and risk management, encompassing the following topics:

Day 1:

- Improving the Efficiency of Factor Strategies

- The Cost of Mitigating Inflation Risk in Equity Portfolios

- The Alchemy of ESG Scores: Can we Turn Lead into Gold?

- Case Study - Enhancing Equity Solutions in a Risk-Controlled and Transparent Process

- Case Study - The Two Sides of the Climate Coin

- Machine Learning in Factor Investing: An Evolution or Revolution ?

Day 2:

- The Impact of Climate Change on Equity Valuation

- Green Window Dressing

- Impact of Concentration Risk on Factor Strategies

- Back to the Future: Backward vs Forward Looking ESG Metrics

- Case Study - A Robust Quality Strategy: A Smooth Ride through Turbulence

- Case Study - Managing Tracking Error of Factor Strategies

- Back to the Future: Backward vs Forward Looking ESG Metrics

Further details are available in the conference programme.

To reserve your complimentary seat, please visit the dedicated web page.

For further information about this event, please contact Joanne Finlay at scientificbetadays@scientificbeta.com.

Admission is only valid when confirmed by the organisers.

The conference is reserved for asset owners (including pension schemes, charities, endowments, foundations, insurance companies, single family offices and financial executives from non-financial companies), consultants and investment advisors.

An Innovative Approach to Quality Investing

A webinar hosted by Felix Goltz, PhD, Research Director at Scientific Beta, and Joseph Simonian, PhD, Senior Investment Strategist at Scientific Beta North America, on 24 September, 2024 presented a new approach to quality investing that blends academically sound definitions of quality with advanced risk management to outperform cap-weighted benchmarks across market cycles.

While quality investment strategies are popular among investment practitioners, their implementation can encounter significant drawbacks. This webinar discussed the following topics:

- Which quality metrics generate outperformance?

- What are quality traps and how can investors avoid them?

- Designing a risk management approach for smooth performance across market cycles

- Why invest in high-quality stocks now?

Scientific Beta stresses need for robust risk management as part of APRA's superannuation performance testing

AdviserVoice (10/10/2024)

"(...) "While the performance of superannuation products has improved following the introduction of the performance test, there are still underperforming products that need improvement, particularly in terms of risk management," said Daniel Aguet, Deputy CEO and Index Director of Scientific Beta. "This underscores the importance of robust risk-controlled strategies for retirement savings, which aligns with Scientific Beta's Market+ framework. This framework allows investors to pursue outperformance and sustainability goals while maintaining tight control over benchmark-relative risk," he said. "Scientific Beta's Market+ framework offers tailored solutions for investors aiming to achieve financial outperformance and sustainability objectives, all while maintaining close alignment with standard market benchmarks," he said. (...)"

Copyright AdviserVoice PTY Limited

Index 2.0: Off-the-shelf or custom indices?

IPE (October 2024)

"(...) Although he believes custom-made standalone ESG indices for equities and bonds will continue to gain traction, Felix Goltz, research director at Scientific Beta, also sees growing demand for a combination of quantitative strategies with an ESG overlay. (...) However, Goltz says that index providers need to explain that sustainability criteria might alter financial risks of an index or dilute the original sustainability objectives. They should identify such issues and help investors navigate the trade-offs between competing objectives in index design. "This is why it is crucial for index providers to assess the robustness of specifications and apply a rigorous research framework when developing these indices," he adds. (...)"

Copyright IPE International Publishers Limited

The name-blame game: why the EU is a lost-leader on ESG taxonomy

Investment News New Zealand (22/09/2024)

"(...) Europe has led the way in 'green' investment product classification. But other jurisdictions shouldn't follow the European Union (EU) down the same naming path, according to Daniel Aguet, Scientific Beta deputy chief. Aguet said the multiple EU directives on sustainable investment taxonomy while paved with good intentions have ended in confusion at best. "The main conclusion is that the good intentions of regulators have had unintended consequences, resulting in less effective outcomes for investors," he said. For example, the ground-breaking EU Sustainable Finance Disclosure Regulation (SFDR) introduced in 2019 faced a major overhaul just four years later in the wake of a reclassification crisis. (...)"

Copyright InvestmentNews.co.nz

Why the crackdown on greenwashing must now go further

Money (12/09/2024)

Article by Daniel Aguet, Deputy CEO and Index Director at Scientific Beta

"(...) The Australian financial regulator ASIC recently published a report on its actions against greenwashing misconduct and concluded that its "surveillance indicates there is ample room for improvement". (...) Hence, going forward the regulator should shift its focus from simply checking whether investment managers use the scores the way they say they do, or whether these scores provide investors with any accurate, reasonably grounded and easily understandable information at all. (...) Until ESG ratings reasonably accurately measure what their providers intend them to measure, and until investors understand what these intentions are, ESG ratings are a source of investor misinformation. And instead of trying to fix the irreparable, Australia would be better off discouraging the use of ESG scores for investor information purposes. (...)"

Copyright ISS - Institutional Shareholder Services

On the same subject:

• ESG ratings often mislead consumers, greenwashing clampdown has further to go, AdviserVoice, 05/09/2024

• ESG ratings risk greenwash, FS Sustainability, 04/09/2024

Mitigating Economic Risk in Multi-Factor Strategies

Enterprising Investor Forum, CFA Institute (19/08/2024)

Article by Joseph Simonian, PhD, senior investment strategist at Scientific Beta

"(...) Investors often choose diversified, multi-factor strategies to overcome the limitations of traditional cap-weighted benchmarks. These benchmarks are overly concentrated on companies with the largest market capitalization and expose investors to idiosyncratic risks that are not rewarded over the long term. Moreover, cap-weighted benchmarks incorporate no explicit objective to capture exposure to those risk factors that have been documented in the academic literature to offer a long-term reward. (...) In this article, I outline a methodology — which we call EconRisk — to mitigate economic risks of factor-driven equity strategies and eliminate unnecessary tracking error by keeping strong exposures to rewarded factors and preserving diversification benefits. (...)"

Copyright CFA Institute

Scientific Beta: How to build a more forward-looking climate change screen

Financial Investigator (23/07/2024)

Article by Erik Christiansen, Head of Investment Solutions, Scientific Beta

"(...) Measuring and controlling the carbon intensity of a portfolio is usually part of a climate investing strategy, and serves two main purposes: 1. Monitoring carbon intensity and reducing it through a combination of investment and engagement decisions is a core part of investors' net zero commitments: what gets measured gets managed. 2. According to the TCFD (Task Force on Climate-related Financial Disclosures), a portfolio's carbon intensity remains a rough proxy for its exposure to climate transition risks, which many investors wish to lower, whether they believe these risks are adequately priced in by markets or not. However, carbon intensity can be cut down in many ways, and the 'how' matters more than the 'how much'. (...)"

Copyright Financial Investigator Publishers B.V.

Scientific Beta

Scientific Beta aims to encourage the entire investment industry to adopt the latest advances in smart factor and ESG/Climate index design and implementation. Established in December 2012 by EDHEC-Risk Institute, one of the top academic institutions in the field of fundamental and applied research for the investment industry, as part of its mission to transfer academic knowhow to the financial industry, Scientific Beta shares the same concern for scientific rigour and veracity, which it applies to all the services that it provides to investors and asset managers. We offer the smart factor and ESG/Climate solutions that are most proven scientifically, with full transparency of both methods and associated risks.

On January 31, 2020, Singapore Exchange (SGX) acquired a majority stake in Scientific Beta. SGX is maintaining the strong collaboration with EDHEC Business School, and principles of independent, empirical-based academic research, that have benefited Scientific Beta’s development to date.

Scientific Beta has developed two types of expertise over the years corresponding to two major concerns for investors:

- Expertise in the area of Smart Beta, and more particularly factor investing

- Expertise in the area of ESG, and particularly Climate investing

To date, Scientific Beta is offering two major types of climate objectives:

Since 2015, offerings with financial objectives respecting ESG and Carbon constraints. These offerings correspond to the application of exclusion filters, the design of which allows the financial characteristics of the index to be conserved. This involves reconciling financial objectives and compliance with ESG norms and climate obligations. As such, the Core ESG, Extended ESG and Low Carbon filters can be integrated into smart beta or cap-weighted offerings in line with the financial objectives targeted by the investor.

Since 2021, Scientific Beta has been offering indices with pure climate objectives (Climate Impact Consistent Indices) that allow climate exclusions and weightings to be combined in order to translate companies' climate alignment engagement into portfolio decisions.

Since it was acquired by SGX in January 2020, Scientific Beta has accelerated its investments in the area of Climate Investing as part of the SGX Sustainable Exchange strategy, which is mobilising an investment of SGD 20 million. In addition, EDHEC and Scientific Beta have set up a EUR 1 million/year ESG Research Chair at EDHEC Business School.

With a concern to provide worldwide client servicing, Scientific Beta is present in Boston, London, Nice and Singapore. Scientific Beta has a dedicated team of 40 people who cover not only client support from Nice, Singapore and Boston, but also the development, production and promotion of its index offering. Scientific Beta signed the United Nations-supported Principles for Responsible Investment (PRI) on September 27, 2016. Scientific Beta became an associate member of the Institutional Investor Group on Climate Change (IIGCC) on April 9, 2021, and a member of the Investor Group on Climate Change (IGCC) on November 28, 2022.

Today, Scientific Beta is devoting more than 40% of its R&D investment to Climate Investing and more than 45% of its assets under replication refer to indices with an ESG or Climate flavour. As a complement to its own research, Scientific Beta supports an important research initiative developed by EDHEC on ESG and climate investing and cooperates with V.E and ISS ESG for the construction of its ESG and climate indices.

On November 27, 2018, Scientific Beta was presented with the Risk Award for Indexing Firm of the Year 2019 by the prestigious professional publication Risk Magazine. On October 31, 2019, Scientific Beta received the Professional Pensions Investment Award for "Equity Factor Index Provider of the Year 2019." On February 1, 2022, Scientific Beta was named "Best Specialist ESG Index Provider" at the ESG Investing Awards 2022, which celebrate excellence in Environmental, Social and Governance (ESG) research, ratings, funds, and products.

|

|

|

|

![]() Scientific Beta

Scientific Beta

2 Shenton Way, #02-02, SGX Centre I, Singapore 068804

Tel. +33 493 187 863

E-mail: info@scientificbeta.com | Website: www.scientificbeta.com